We work with more than 200 lenders across the country. Because of this, and the relationships we’ve built with regulators, we are positioned to move fast.

We don’t wait to find out what your loan documents need. We’re in the room when it happens. Where other platforms lag for months, we update in real time because our system is built smarter, lean and agile without all the red tape.

Here’s what’s new from Q1, live, tested, and ready for use.

Dealing with layered liens just got simpler. We launched a new Intercreditor and Subordination Agreement for all 50 states, built for deals involving multiple lenders where lien position, payment rights, and enforcement terms need to be airtight versus patched together after the fact.

It covers CFL, DRE, CRMLA, and exempt lenders, works across borrower types from individuals to trusts, and includes automatic subordination adjustments for most modifications.

Pricing: $199 per transaction, with unlimited redraws.

Ready out of the box. No outside counsel needed. No last-minute rewrites.

We developed new natural hazard protections that give lenders stronger rights when properties are damaged by events like wildfires, hurricanes, or tornadoes. These updates allow lenders to require that insurance proceeds be used to improve the property to a more defensible condition, not simply rebuild it as it was.

If the property cannot be rebuilt safely, lenders have the right to decline restoration altogether. Fund control oversight can be required for any repair work, and lenders can demand a reassessment of the restoration budget, along with borrower contributions if the budget comes up short.

Lenders can also refuse to approve a rebuild if it cannot be completed before the loan’s scheduled maturity date. Additionally, borrowers can be required to provide proof of eligibility for any state or federally mandated forbearance programs, giving lenders another layer of protection when disaster strikes.

We added support for lenders who want ongoing fire prevention compliance after closing. Lenders can now require borrowers to complete annual NFPA inspections and certifications, along with implementing and reporting on fire mitigation measures if the property is located in a wildfire-prone area. These requirements give lenders stronger ongoing risk management throughout the life of the loan. Protecting the loan doesn’t stop at closing.

For construction loans, we expanded the natural disaster protections even further. If a fire occurs before project completion, lenders can require the property to be rebuilt using a more defensible design. They can also require a new budget assessment, demand additional borrower contributions to cover any cost shortfalls, and control how insurance proceeds are used. Proceeds can be limited to projects that can be completed before the loan’s maturity date, protecting the lender from unfinished or non-viable rebuilds. Additional hazard mitigation measures can be required during reconstruction, and fund control oversight can be mandated for the handling of insurance proceeds.

As of Q1 2025, all of these protections are standard in our Business Purpose and Construction docs—live, tested, and ready for use.

CONTINUE READING PRODUCT UPDATES

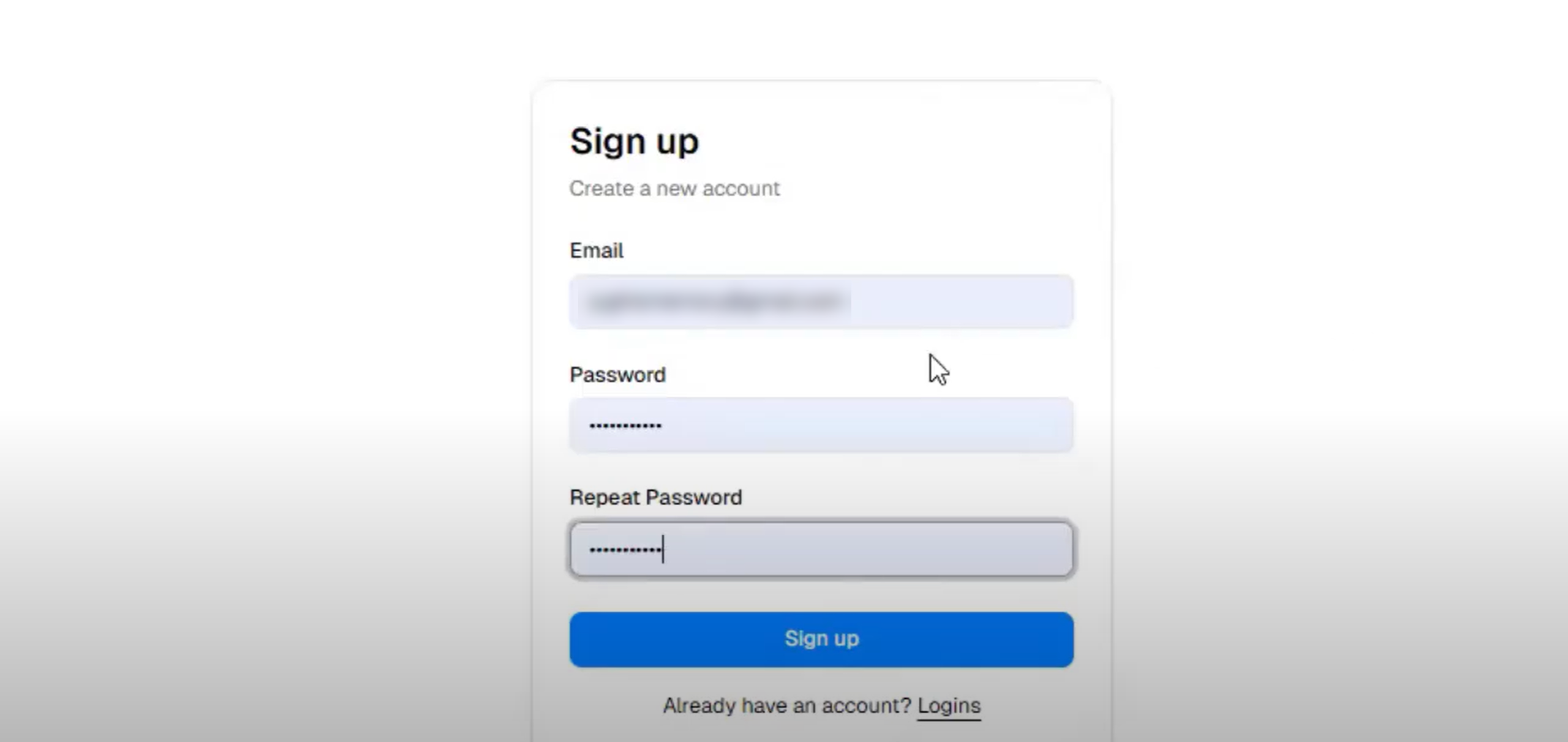

No contract. No subscription or upfront cost. One simple click for instant access.

We also improved how users complete the Business Purpose Certificate. Built-in prompts now guide users through the completion process of the Business Purpose Certificate. This enhancement helps ensure the certificate is filled out thoroughly and accurately, reducing errors and unnecessary rework. It’s a tool that helps users get it right the first time and keeps loans moving.

We updated the platform to allow separate allocation of impounds and premiums paid at closing for property taxes and insurance. This makes it easier to track amounts accurately and match how lenders structure their closing statements. No manual adjustments needed after the fact.

We added new functionality that allows multiple properties in the same county to be secured under a single security instrument or deed of trust. The platform supports up to two instruments by default, with custom options available if a different structure is needed. It’s a simple way to handle multi-property deals without extra workarounds.

Lenders can now enter MIN and MERS information directly during document generation. This helps ensure clean, compliant loan documents ready for recording and future transfers.

Beyond MIN and MERS, we addressed key principal risk directly.

We added an option that allows lenders to call the loan if a key principal passes away. The key principal typically guarantees repayment, manages the property, or both. Without that person, lenders can be left dealing with heirs, inactive entities, or defaulted obligations. This provision gives lenders the ability to act quickly and safeguard their investment.

We expanded our prepayment penalty options to give lenders more flexibility. Lenders can now apply a six-month interest charge on amounts prepaid beyond 20% of the original loan balance, enforceable for up to three years. The platform also supports a full range of graduated and fixed prepayment structures, built in and ready to use.

We also made it easier to generate the right documents when a purchasing investor is involved.

Our platform now supports table funding at closing, allowing lenders and brokers to generate fully compliant closing documents when a purchasing investor is funding the loan. Table funding is available for transactions outside of California, helping prevent escrow disruptions, ensure correct assignments and disclosures, and protect the funding process through the purchasing investor.

We update our platform with our lenders in mind, the way the market demands, and regulations require, nationwide. Every change is built to protect the lender’s position, ensure compliance, and keep deals moving without disruption so that lenders deliver faster, cleaner closings to their borrowers.

These new wildfire risk and other natural disaster provisions are available immediately. If you’re already using Doss Docs, you are all set. If not, it’s time to make a change.

Protect your loans today with Doss Docs. Instant access, no subscription, 50-state compliant.