This report covers what we’ve seen through Q1 2025, with a full look back at 2024. We’re highlighting four of DossDocs’ core On Demand Loan Document products: Business Purpose, Investor Docs, Construction Docs, and Mods & Extensions. No surprise, Business Purpose is the top performer.

Across the board, loan doc volume grew. Business Purpose volume jumped 138% from January 2024 through Q1 2025. Investor Docs up 80%. Construction Docs grew 41% year-over-year. Modifications and Extensions up 300%.

But it’s not just more deals. It’s more structured deals. Loan sizes are up. Servicing terms are showing up more often. Broker disclosures are in demand. In Q1, 85% of Business Purpose loans involved a broker. Each Investor deal did too. With Investor Doc volume up 80%, that’s a major increase in disclosures, and DossDocs includes them automatically with every package.

In Q1 alone, average loan sizes rose sharply, and repeat lenders submitted more complex, better-structured packages. These trends are based on activity from 335 users across the DossDocs platform.

Lenders aren’t sitting still. They’re adjusting, scaling, and documenting smarter.

From January 2024 to March 2025, Business Purpose (BP) doc volume grew 138% based on compounded monthly gains. That growth accelerated across quarters, marked by steady increases in volume. Comparing Q1 2025 to Q1 2024 alone, volume rose 23%. That kind of growth reflects demand for small-balance lending and shows that private lenders are staying active while other capital sources have pulled back.

Repeat lender activity showed strong growth. From January 2024 through March 2025, doc submissions from repeat lenders increased by 87%. Repeat lender activity remained strong, accounting for 96% of BP docs in Q1 2025 unchanged from Q1 2024. We did see a change in the nature of their deals. They were larger and more structured.

Rates for business purpose loans hovered in a narrow range over the past year, averaging 11.84%. The highest rate came in June at 12.24%. The high point was 12.24% in June. The low was 11.18% in January, creating a 106 basis point spread between the highest and lowest months. By April 2025, the average rate had settled at 11.23%, near the bottom of the yearly range.

Average loan amounts moved more noticeably. They started at just over $600K in April 2024 and hit a high of $834K in December. Loan sizes dropped sharply in January to $387K, then climbed back above $650K in February. The March average held steady at just over $617K. The shifts likely reflect asset types and timing more than rate movement, especially since some of the largest months for volume came while rates were still elevated.

From January 2024 through March 2025, Investor Doc volume grew by 80% from Q1 2024 to Q1 2025. 80% of loans were under $1.5 million, pointing to continued strength in the small-balance market.

We’re also seeing a shift in who’s putting money to work. 47% came from individuals and 42% from trusts and estates. This is more than a side hustle. These are structured investments backed by real allocation strategies, reflecting more strategic capital and higher expectations from everyone at the table.

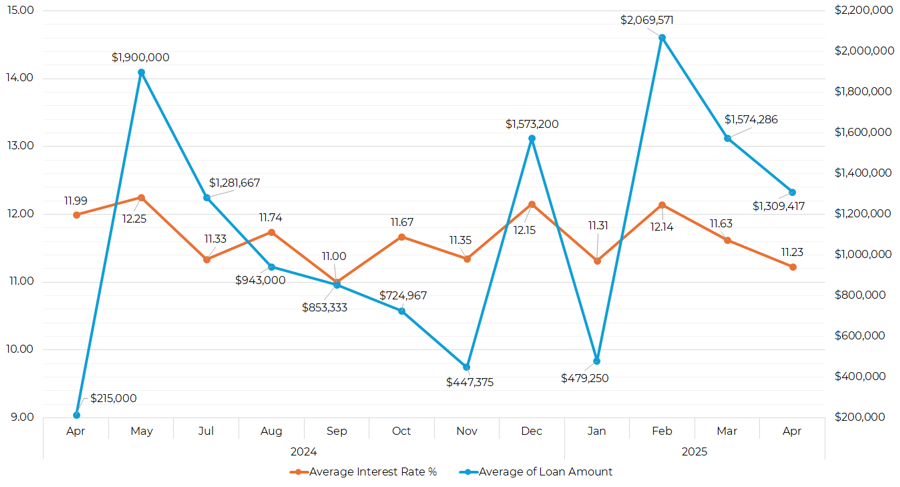

Investor loan rates remained relatively steady over the past year, averaging 11.67%. After peaking at 12.25% in May, rates moved slightly up and down but stayed within a narrow range, ending at 11.23% in April 2025. That’s a 102 basis point drop from the high.

Loan amounts shifted month to month, likely driven by project timing and the types of borrowers active in the market. The average ranged from $215K in April 2024 to a high of over $2 million in February 2025, with a strong rebound in Q1 and three straight months of seven-figure loan sizes (January, February, and March). That February spike came even with an average rate of 12.14%, suggesting that demand held strong despite higher pricing.

Construction Docs volume increased 41% from Q1 2024 to Q1 2025. While volume fluctuated quarter to quarter, Q1 2025 saw the largest increase—up 63% from Q4 2024. That growth reflects rising use by repeat lenders and more formal construction loan documentation across the board, including fund control and servicing terms.

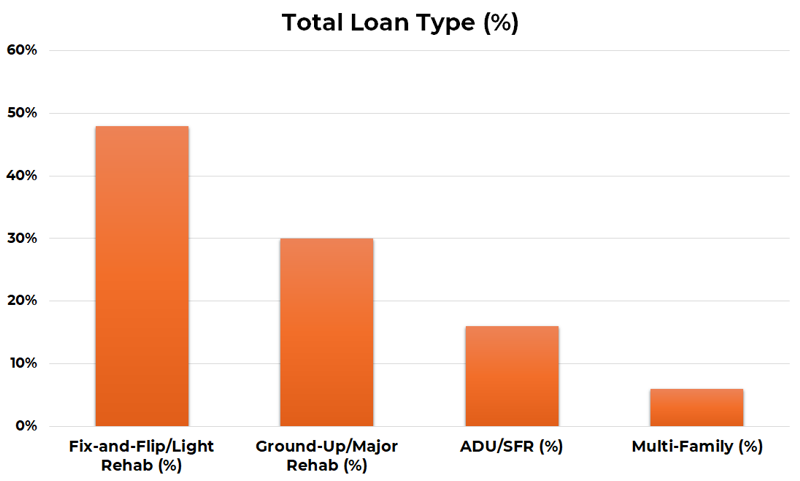

Looking at the loan types, 48% were fix-and-flip or light rehab deals, while 30% were ground-up or major construction projects. The rest skewed toward ADU and small-scale SFR improvements. This mix points to a shift: more lenders are documenting construction projects that require real planning, phasing, and oversight.

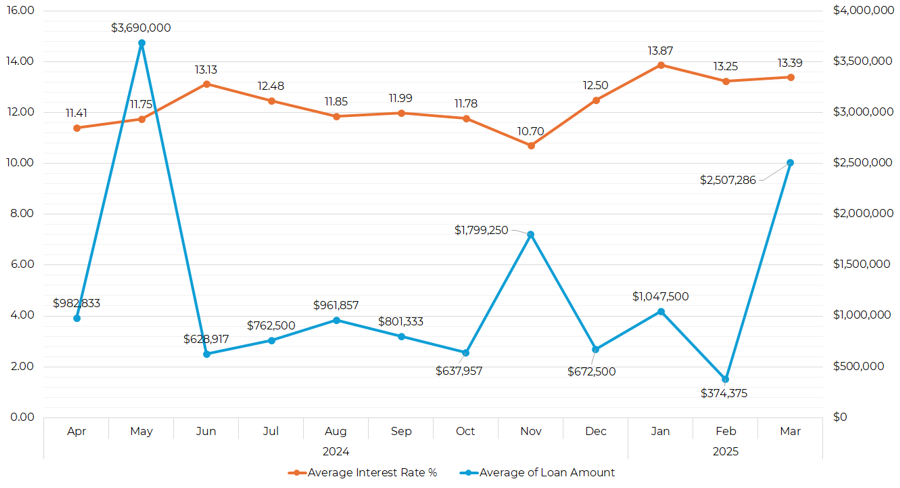

Rates for construction loans trended higher over the past 12 months, averaging 12.20%. The monthly average peaked at 13.87% in January 2025 and hit a low of 10.70% in November, a spread of 317 basis points. By March, the average rate stood at 13.39%, near the top of the yearly range.

Loan amounts varied more month to month. May and March (warmer build months) had some of the highest average loan sizes, with May at $3.69M and March at $2.5M. February came in low at $374K, likely due to fewer large projects ready to fund at the tail end of winter. March jumped noticeably with $2.5M, a clear sign that construction deals were getting ready to move as the spring season approached.

From Q1 2024 to Q1 2025, modification and extension doc volume on our platform grew 300%. While growth was consistent through 2024, Q1 2025 saw a sharp increase in activity. That spike shows borrower commitment, with more lenders and borrowers opting to stay in deals rather than exit.

These weren’t distressed or one-off requests. Borrowers remained committed, requesting time rather than walking away. Lenders showed a willingness to extend, indicating confidence in the underlying assets and borrowers’ ability to perform.

Average loan size also increased by 41% from Q1 2024 to Q1 2025. Lenders are extending larger loans, often adding servicing or documentation requirements to support investor communication. The loan docs are more detailed, not less.

Complete the brief form below to receive the full quarterly report via email.