Start the all-inclusive financing off on firm footing with a carefully written offer or counteroffer. Use this seller financing contract template to avoid confusion and disputes when the buyer sees the final documents. The four objectives include:

Let’s begin. The following sections of the seller financing contract template will show you the details of what to include.

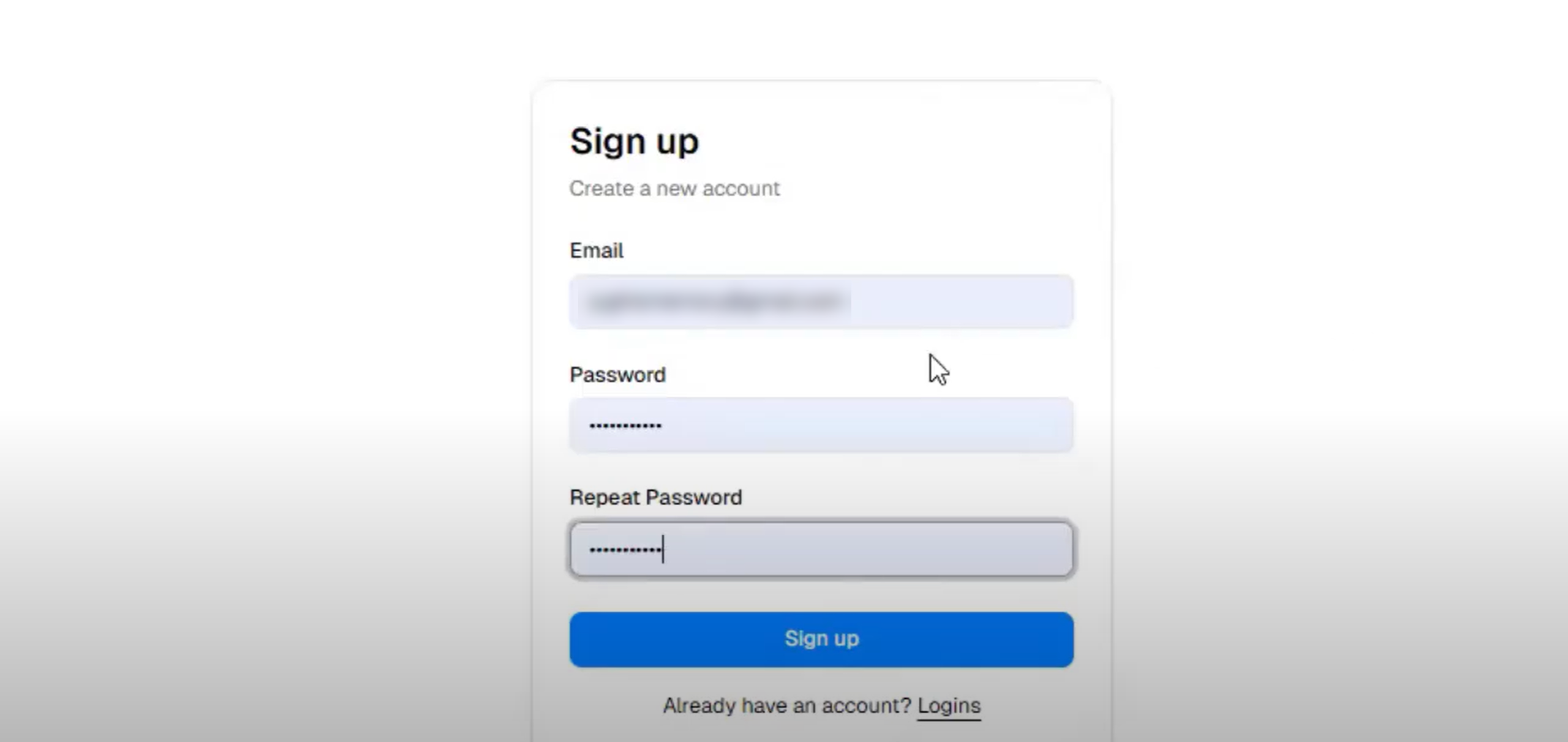

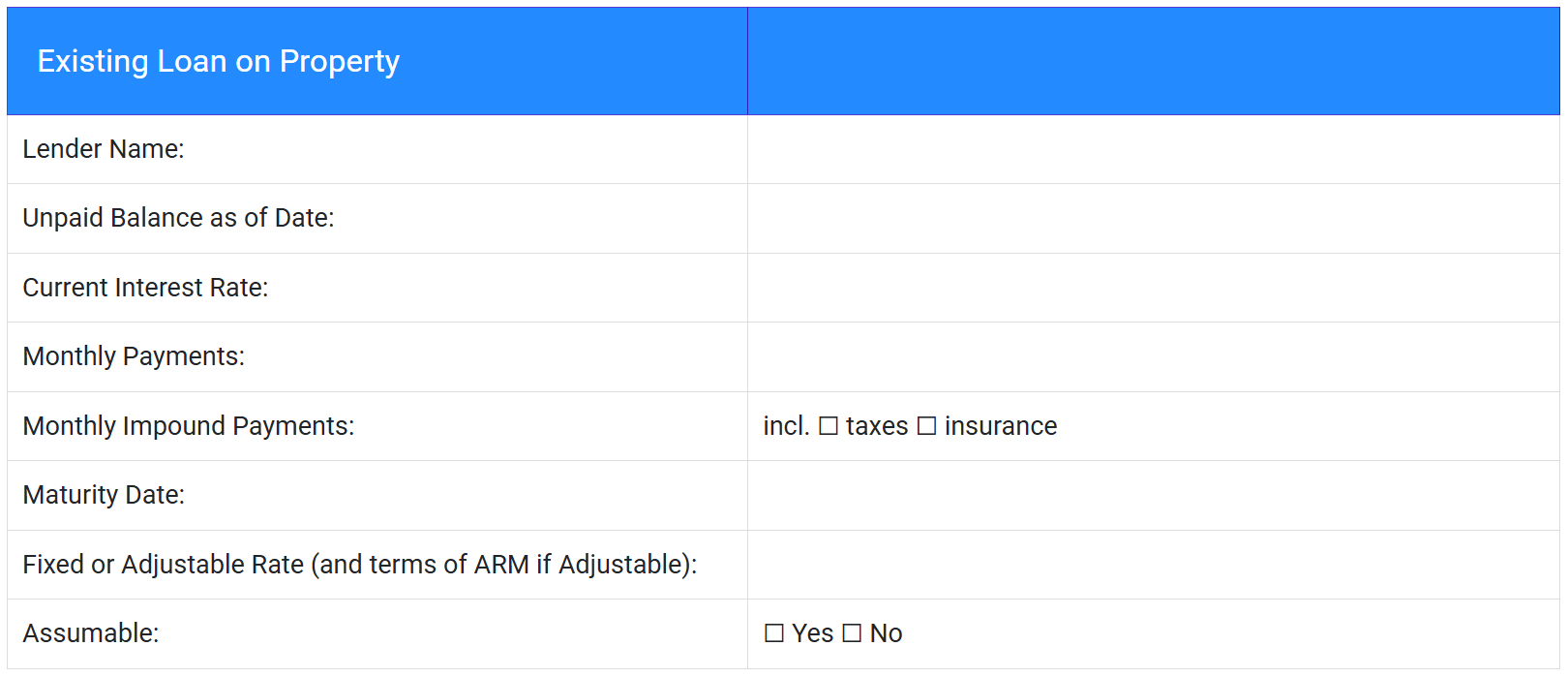

In your offer or counteroffer, within this seller financing contract template, you will want to list the salient details about the existing mortgage, such as:

Seller discloses the following about the existing loan on the property and will provide, within 5 calendar days after signature to the purchase agreement by both parties a copy of the promissory note, security instrument and most recent monthly mortgage statement concerning the existing loan.

A summary of material terms follow:

|

Existing Loan on Property

|

|

|---|---|

|

Lender Name:

|

Bank of America N.A.

|

|

Unpaid Balance as of Date:

|

$352,000 as of August 1, 2025

|

|

Current Interest Rate

|

2.50%

|

|

Monthly Payments:

|

$745.23

|

|

Monthly Impound Payments:

|

$256.22 incl. ☐ taxes ☐ insurance

|

|

Maturity Date:

|

May 1, 2050

|

|

Fixed or Adjustable Rate (and terms of ARM if Adjustable):

|

Adjustable. SOFR Index, 3.5% margin, 1% adjustment caps, annual adjustments

|

|

Assumable:

|

☐ Yes ☐ No

|

You don’t have to do a fancy table; you can just list the points and the values for those items. If you attach the mortgage statement, you can reference it and supply any missing information.

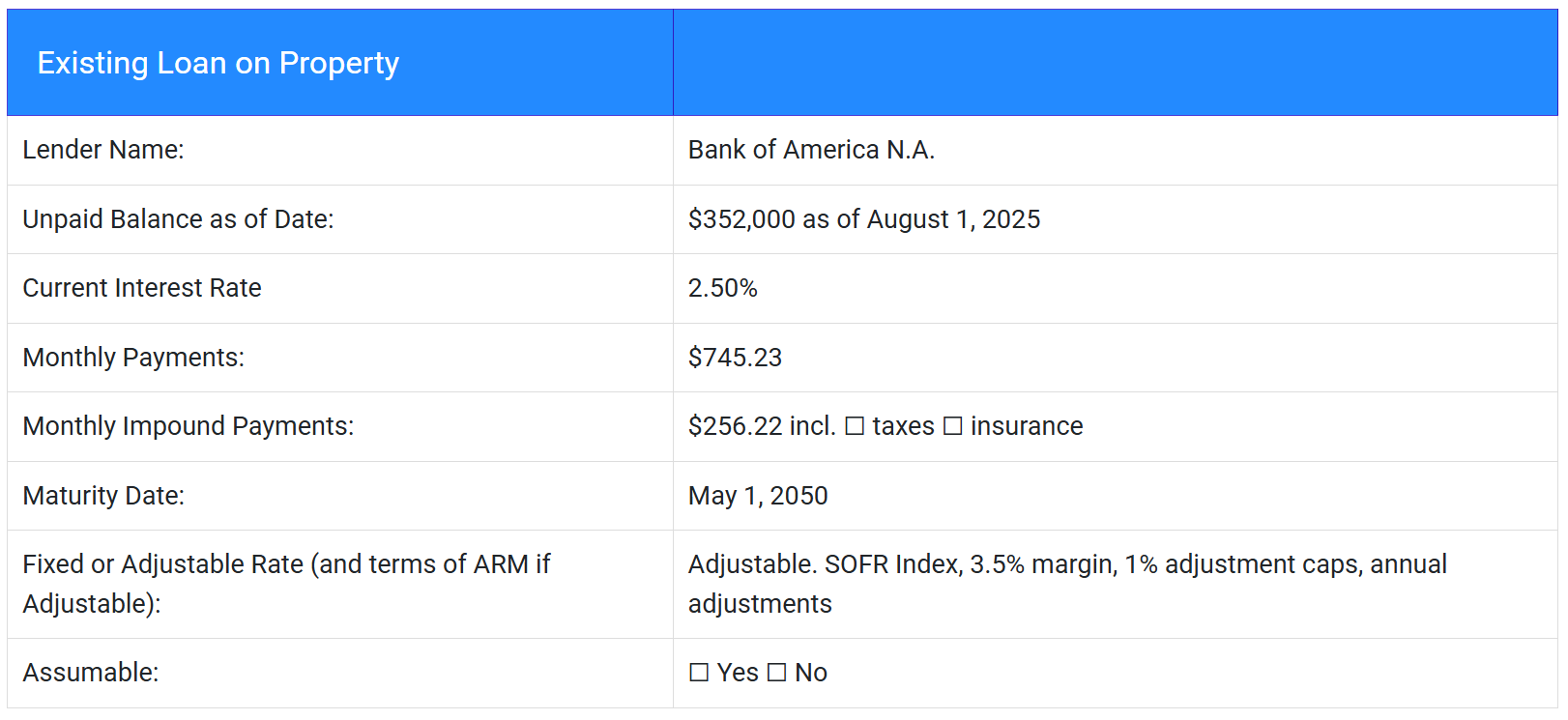

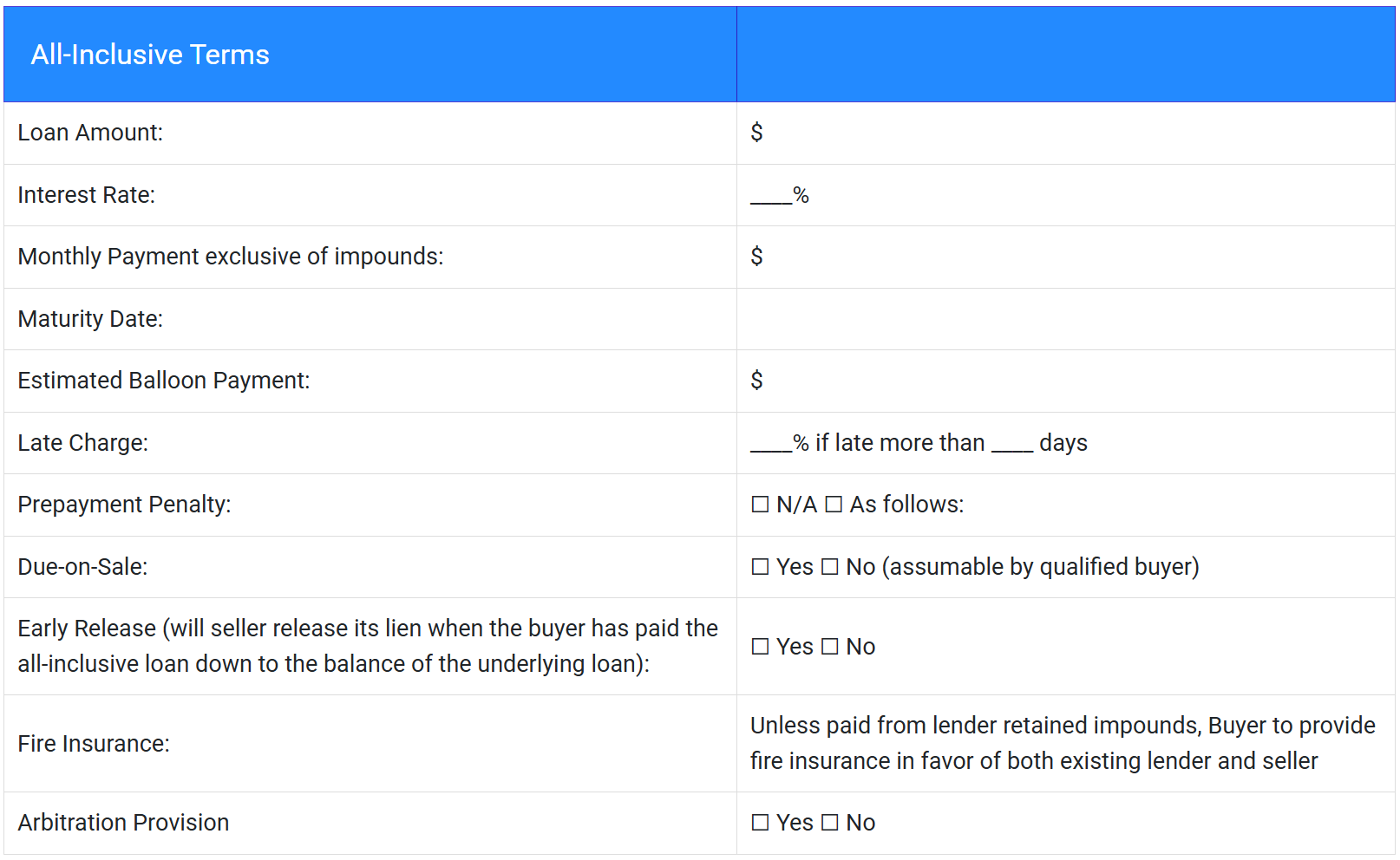

Next, as shown below in this seller financing contract template, you need to provide the financial details of the proposed seller financing. Here is one way to do it:

The terms of seller financing shall be as follows to be evidenced by a promissory note and second priority deed of trust or mortgage in favor of Seller(s) containing otherwise industry-standard terms listed below. Buyer and Seller are aware there is some risk the existing lender will call the loan because of the transfer of title. If that occurs it will be Buyer’s responsibility to immediately refinance to repay the entire amount due Seller.

|

All-Inclusive Terms

|

|

|---|---|

|

Loan Amount:

|

$375,000

|

|

Interest Rate:

|

5%

|

|

Monthly Payment exclusive of impounds:

|

$1,562.50 interest only

|

|

Maturity Date:

|

5 years from closing

|

|

Estimated Balloon Payment:

|

$376,562.50

|

|

Late Charge:

|

6% if not paid by 15th of the month

|

|

Prepayment Penalty:

|

6 months’ interest on any amount prepaid in one year in excess of 20% of the loan amount

|

|

Due-on-Sale:

|

Yes

|

|

Early Release (will seller release its lien when the buyer has paid the all-inclusive loan down to the balance of the underlying loan):

|

No

|

|

Fire Insurance:

|

Unless paid from lender retained impounds, Buyer to provide fire insurance in favor of both existing lender and seller

|

The seller will want to make it clear that the seller has the right to vet the buyer and provide financing to the buyer only if the buyer is creditworthy (discussed next).

The seller will want to say something like this in the offer or counteroffer:

“Seller shall have the right to decline to provide seller financing if it disapproves of Buyer’s creditworthiness, by written notice given within X calendar days after receipt of all items listed below. If Seller declines to provide financing, Seller may cancel this transaction without further cost or obligation. Any deposit by Buyer shall be promptly refunded.”

Lastly, the offer or counteroffer should carefully list what the Seller will want to review and when the Buyer must provide it.

Here is sample language and a list:

Within 3 calendar days from signature by all parties to a purchase agreement, Buyer shall provide to Seller:

Seller promises to keep Buyer’s information confidential and to preserve and protect all documents provided.

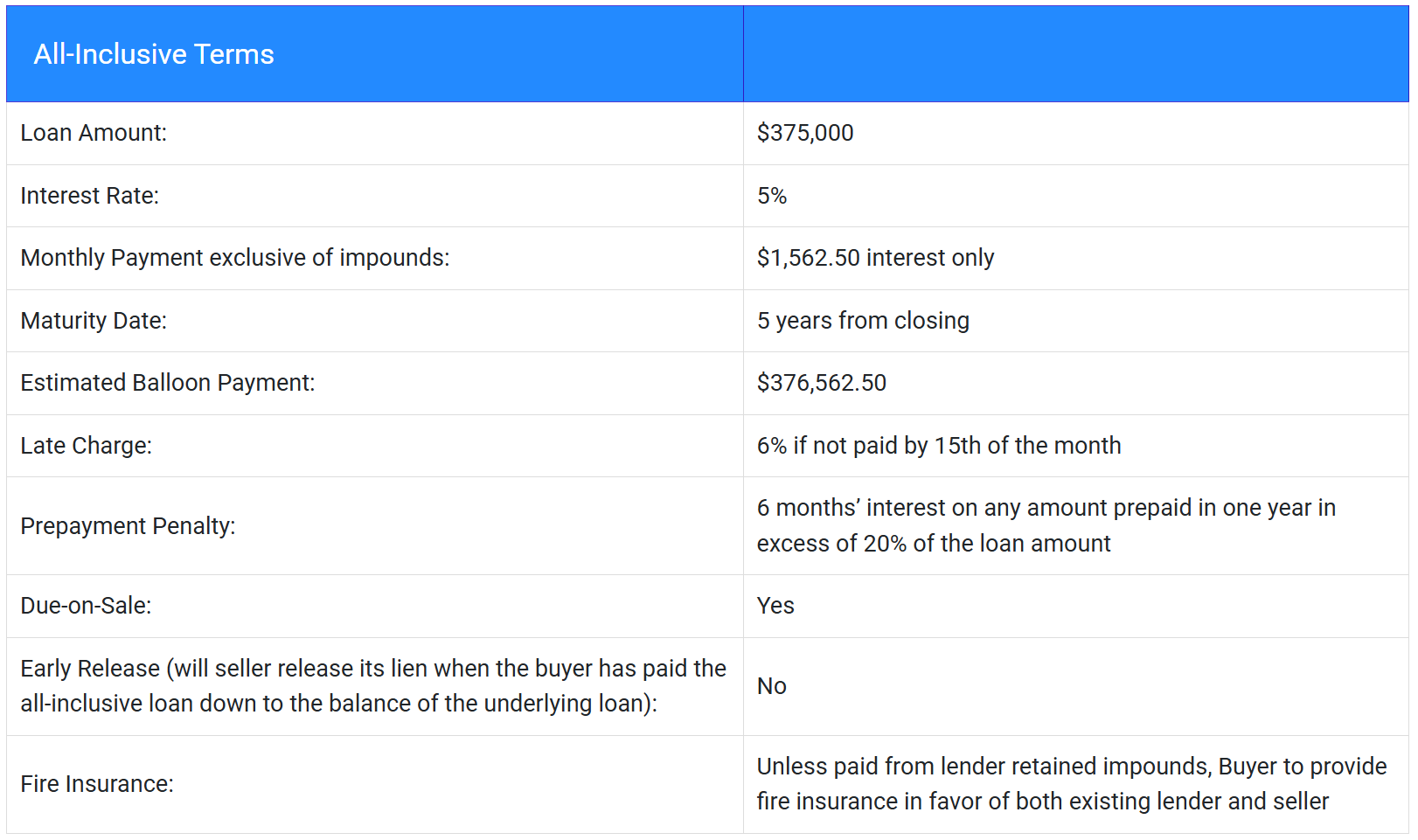

Putting it all together, in this seller financing contract template, the offer or counteroffer should look something like this:

|

|

|

|---|---|

|

Seller Financing Addendum No.:

|

|

|

Property Address:

|

|

|

Seller(s):

|

|

|

Buyer(s):

|

__________________________________________

|

|

Date:

|

|

A.

Seller discloses the following about the existing loan on the property and will provide, within 5 calendar days after signature, the purchase agreement by both parties, a copy of the promissory note, security instrument and most recent monthly mortgage statement concerning the existing loan. A summary of material terms follows:

|

Existing Loan on Property

|

|

|---|---|

|

Lender Name:

|

|

|

Unpaid Balance as of Date:

|

_______________________________________________________________

|

|

Current Interest Rate:

|

|

|

Monthly Payments:

|

|

|

Monthly Impound Payments:

|

incl. ☐ taxes ☐ insurance

|

|

Maturity Date:

|

|

|

Fixed or Adjustable Rate (and terms of ARM if Adjustable):

|

|

|

Assumable:

|

☐ Yes ☐ No

|

B.

The terms of seller financing shall be as follows to be evidenced by a promissory note and second priority deed of trust or mortgage in favor of Seller(s) containing otherwise industry standard terms listed below. Buyer and Seller are aware there is some risk the existing lender will call the loan because of the transfer of title. If that occurs it will be Buyer’s responsibility to immediately refinance to repay the entire amount due Seller.

|

All-Inclusive Terms

|

|

|---|---|

|

Loan Amount:

|

$

|

|

Interest Rate:

|

____%

|

|

Monthly Payment exclusive of impounds:

|

$

|

|

Maturity Date:

|

|

|

Estimated Balloon Payment:

|

$

|

|

Late Charge:

|

____% if late more than ____ days

|

|

Prepayment Penalty:

|

☐ N/A ☐ As follows:

|

|

Due-on-Sale:

|

☐ Yes ☐ No (assumable by qualified buyer)

|

|

Early Release (will seller release its lien when the buyer has paid the all-inclusive loan down to the balance of the underlying loan):

|

☐ Yes ☐ No

|

|

Fire Insurance:

|

Unless paid from lender retained impounds, Buyer to provide fire insurance in favor of both existing lender and seller

|

|

Arbitration Provision

|

☐ Yes ☐ No

|

C.

Seller shall have the right to decline to provide seller financing if it disapproves of Buyer’s creditworthiness, by written notice given within calendar days after receipt of all items listed below. If Seller declines to provide financing, Seller may cancel this transaction without further cost or obligation. Any deposit by Buyer shall be promptly refunded.

D.

Within 3 calendar days from signature by all parties to a purchase agreement, Buyer shall provide to Seller:

Seller promises to keep Buyer’s information confidential and to preserve and protect all documents provided.

[Signatures]

[1] Dennis H. Doss, is the manager of Doss Law, LLP and a 47-year veteran in mortgage law. He is a frequent expert witness in mortgage cases, a frequent speaker at industry events and the creator of DossDocs.com, a nationwide loan document company.

DossDocs LLC. This article is for educational purposes only and is not legal advice. Consult a qualified lawyer before acting on any of the ideas discussed here.

Get started.

Prudent legal advice comes from experience. We have over 60 years of it.