After the Great Recession and pandemic that followed it, mortgage rates dropped to all-time lows. Some lucky homeowners were able to secure 2% to 4% mortgages. Many of the same homeowners have been wanting to sell for a while but don’t want to give up their low-rate mortgage to then have to pay an interest rate that is double or more. To them, the low-rate mortgage is a valuable asset that is holding them back from moving. The low rate is an anchor that prevents them from seeking more space, downsizing, relocating, or making a lifestyle change.

Most homeowners don’t realize they have options. One of them is selling their home “subject to” the existing mortgage. That means the buyer takes title to the home, but the original mortgage stays in place. The buyer gets credit for the amount owed on the existing mortgage and makes a cash down payment. The seller then finances the remainder of the purchase price by giving the buyer a second mortgage that includes, or “wraps,” the existing loan. In other words, the buyer gives the seller a promissory note for an amount that includes the old mortgage, which will stay on the property after title transfers. We call this mortgage an “all-inclusive mortgage” or AITD, otherwise known as a “wrap-around” mortgage.

In the wrap-around mortgage, the buyer pays the seller a higher interest rate than the existing mortgage, but still lower than the current market rate. The seller pockets the difference — a goldmine. Specifically, the buyer gives the seller a promissory note for an amount higher than the existing first mortgage, secured by a second mortgage on the property. That second mortgage gives the seller the legal right to foreclose if the buyer doesn’t pay. The seller takes the buyer’s monthly payment, pays the existing first mortgage and pockets the rest. In essence the seller has “wrapped” the existing, low rate first mortgage with its own, slightly higher rate mortgage. The seller can then use that income to offset the higher rate they are paying on the loan they take out to buy a new home.

Let’s look at an example.

Let’s say for instance the seller’s home has a 30-year mortgage of $500,000 and the interest rate is 2.5%. The house is sold for $600,000 and the seller takes a promissory note for just a little over the amount owed on the existing mortgage, let’s say $5,000 (but it could be any amount). The buyer gets credit for the existing $500,000 mortgage and pays the rest in cash. The all-inclusive loan is for $505,000 at 5% per annum—a great rate today.

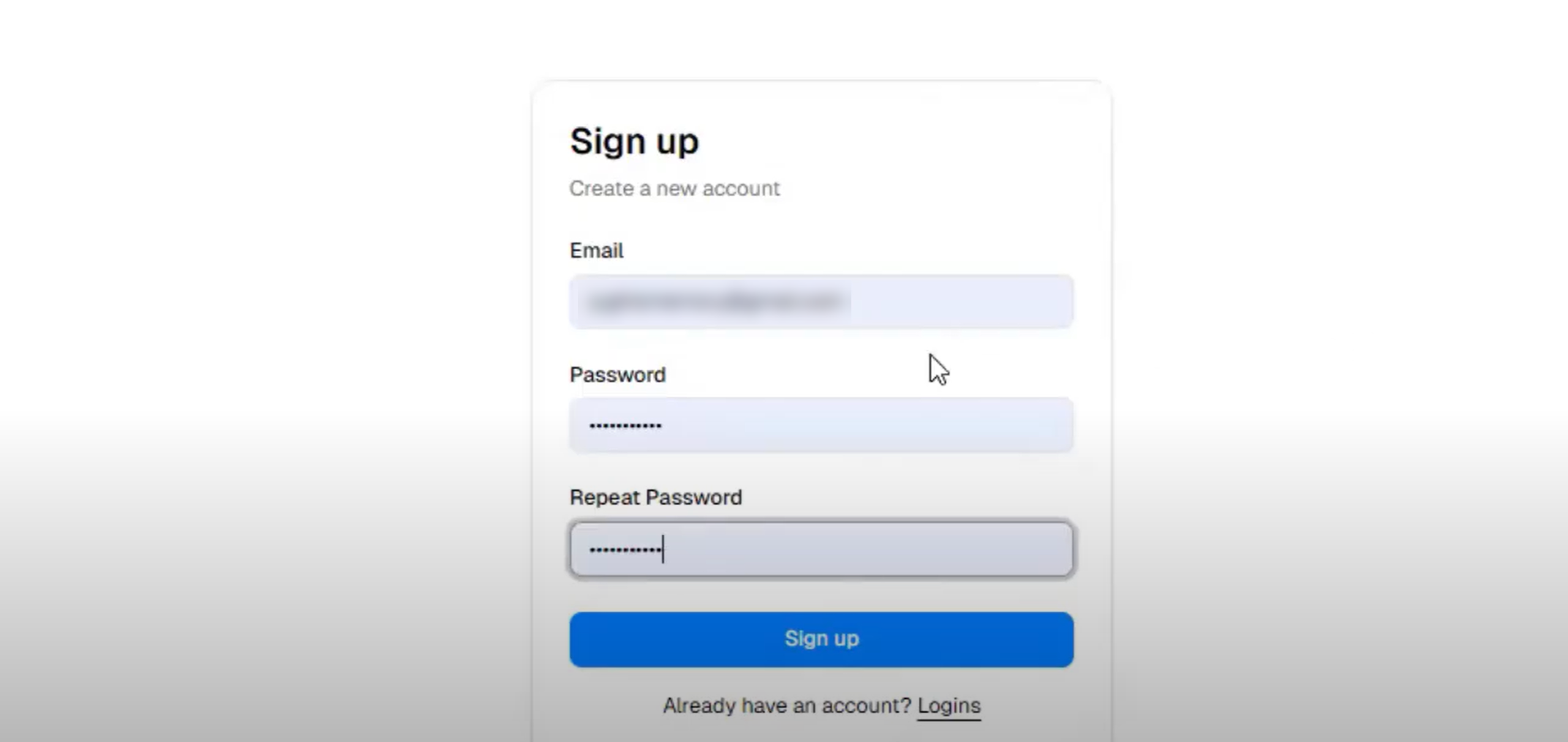

Get 50-state, attorney-quality, compliant documents in minutes.

No contract. No subscription or upfront cost. One simple click for instant access.

Each month the seller pockets 2.5% interest on $505,000 or about $1,052 or $63,125 over, let’s say, 5 years. And if the documents provide for it (unusual), the seller can retain the benefit of the amortization of the underlying mortgage, another $58,000.

The buyer and seller in our example just found a way to create value for both from the low-rate mortgage.

The seller’s profit will help ease the pain of paying a higher mortgage for the new home they are buying. If the seller takes out a new $500,000 mortgage to buy a new home with a current rate of 6.5%, the seller’s net rate drops to only 4%—a great rate today. The seller went from 2.5% to 4% in a 6.5% rate environment—not a bad deal. And the buyer gets a below market rate too at 5%. It is a win-win for both!

Of course it is. Sellers have been carrying back mortgages on the sale of their property for decades. There is nothing new about it.

Absolutely not. Fraud is misrepresenting some fact. A seller carryback is above-board, and nothing is hidden or insidious about them.

Technically, that is true. It’s called a due-on-sale clause in the loan contract. But they are rarely, if ever, enforced.

Why? Because the average mortgage loan is pooled with others and sold on the stock market as mortgage-backed securities. The trustees of these pools have no marching orders to call loans because there was a transfer of title. Good all-inclusive loan docs (like those at DossDocs.com) will give the buyer time to refinance if the old mortgage company calls the loan because of a transfer of title.

In a worse case the buyer will have to refinance and pay the old mortgage, and the amount owed to the seller. If the amount owed to the seller is substantial, well written docs will allow for replacement of the existing mortgage while retaining the amount owed to the seller.

This is a genuine risk, so a smart seller will want to vet the buyer ahead of time by asking for a credit report, financial statement, bank and stock statements. An all-inclusive with a shaky buyer is foolhardy. If the buyer doesn’t pay the seller, the seller will be forced to continue paying his or her old mortgage to preserve his or her credit while foreclosing on the buyer. That can take a few months. The buyer will have to repay the seller in full to avoid losing the house in foreclosure.

Well written all-inclusive docs will give the buyer the ability to deduct the amount of interest paid to the seller and to the old mortgage company. Federal law may limit the amount of the deduction depending on the buyer’s income. The profit the seller makes is taxable at ordinary income tax rates.

DossDocs.com offers a do-it-yourself solution available in all 50 states for $499 per transaction. You answer a simple workflow and get your documents instantaneously any time, anywhere. The mortgage documents are based on the Fannie Mae format, the national standard for home lending. If you make a mistake in the workflow, you can re-draw them at no cost. No registration is required. You can use the program, or your real estate agent or lawyer can do it for you.

[1] Dennis H. Doss, is the manager of Doss Law, LLP and a 47-year veteran in mortgage law. He is a frequent expert witness in mortgage cases, a frequent speaker at industry events and the creator of DossDocs.com, a nationwide loan document company.

These new wildfire risk and other natural disaster provisions are available immediately. If you’re already using Doss Docs, you are all set. If not, it’s time to make a change.

Protect your loans today with DossDocs. Instant access, no subscription, 50-state compliant.

Get started.

Prudent legal advice comes from experience. We have over 60 years of it.